Investment Future Value Calculator

Investment growth depends on returns and time. Project future value for retirement and wealth planning.

How the Investment Future Value Calculator works

Model various investments: stocks, bonds, real estate. Apply different return scenarios and time horizons for comprehensive wealth projections.

Investment success requires long-term thinking. This calculator visualizes growth potential, motivating disciplined investing.

How it works

Tutorial

Investment future value calculation transforms abstract retirement goals into concrete action plans. Saying “I want to retire comfortably” is vague; calculating that $500/month invested at 8% for 30 years creates $679,000 is specific and actionable. Understanding FV projections helps investors compare options (stocks vs bonds vs real estate), set realistic goals, determine required monthly contributions, and stay motivated during market volatility by visualizing long-term outcomes rather than fixating on daily price swings.

Different investment types require different return assumptions and timeframes. Stock portfolios historically return 9-10% annually but with high volatility; bonds return 4-6% with lower volatility; real estate might deliver 8-12% including appreciation and cash flow. Using appropriate return assumptions for each asset class, accounting for inflation (typically 3%), and running multiple scenarios (conservative/base/optimistic) provides realistic range of outcomes. This analytical approach prevents both excessive pessimism (“I’ll never be able to retire”) and dangerous optimism (“I’ll just get lucky with stocks”).

The Basic Formula

| Scenario | Formula | Use Case |

|---|---|---|

| Lump Sum | FV = PV × (1 + r)ⁿ | One-time investment grows |

| Regular Contributions | FV = PMT × [((1 + r)ⁿ – 1) / r] | Monthly/annual investing |

| Combined | FV = PV(1 + r)ⁿ + PMT × [((1 + r)ⁿ – 1) / r] | Initial amount + regular additions |

| Real Returns | Real r = [(1 + nominal r) / (1 + inflation)] – 1 | Purchasing power adjusted |

Step-by-Step Calculation

Example: Compare three investment scenarios: 1) $50K in stocks, 2) $50K in bonds, 3) $20K initial + $400/month stocks; all 20 years, different returns

Step 1: Calculate Stock Portfolio (High Return/Volatility)

| Input | Value | Assumption |

|---|---|---|

| Initial Investment | $50,000 | Lump sum |

| Annual Return | 9% | Historical stock average |

| Time Period | 20 years | Investment horizon |

| Growth Factor | (1.09)²⁰ | 5.6044 |

| Future Value (Nominal) | $50,000 × 5.6044 | $280,221 |

| Inflation (3%) | (1.03)²⁰ = 1.8061 | Purchasing power erosion |

| Real FV (Today’s Dollars) | $280,221 / 1.8061 | $155,126 |

Step 2: Calculate Bond Portfolio (Lower Return/Volatility)

| Component | Calculation | Result |

|---|---|---|

| Initial Investment | Same | $50,000 |

| Annual Return | Lower risk asset | 5% |

| Growth Factor | (1.05)²⁰ | 2.6533 |

| Future Value (Nominal) | $50,000 × 2.6533 | $132,665 |

| Real FV (Today’s Dollars) | $132,665 / 1.8061 | $73,449 |

| Difference vs Stocks | $155,126 – $73,449 | $81,677 less |

Step 3: Calculate Monthly Contribution Strategy

| Component | Calculation | Result |

|---|---|---|

| Initial Investment | Smaller lump sum | $20,000 |

| Monthly Contribution | Regular investing | $400 |

| Annual Return (stocks) | 9% annual = 0.75% monthly | 0.0075 |

| Total Periods | 20 years × 12 | 240 months |

| Lump Sum FV | $20,000 × (1.0075)²⁴⁰ | $112,088 |

| Monthly Contributions FV | $400 × [((1.0075)²⁴⁰ – 1) / 0.0075] | $245,453 |

| Total FV | $112,088 + $245,453 | $357,541 |

| Total Contributed | $20,000 + ($400 × 240) | $116,000 |

| Investment Gains | $357,541 – $116,000 | $241,541 (208%) |

What This Means

Three investment strategies produce dramatically different results: 1) $50K stocks becomes $280K nominal ($155K inflation-adjusted), 2) $50K bonds becomes $133K nominal ($73K real)—53% less due to lower returns, and 3) $20K + $400/month becomes $358K—27% more than the $50K stock lump sum despite investing less upfront ($20K vs $50K). This demonstrates that consistent monthly contributions often outperform larger lump sums, especially when starting capital is limited.

The stocks vs bonds comparison shows opportunity cost of safety: bonds’ 5% return creates $73K real value vs stocks’ $155K—giving up $82K (53%) for lower volatility. For 20-year horizons, most investors under 50 should favor stocks despite volatility because time heals short-term fluctuations. The monthly contribution strategy generated $358K from $116K invested—a 208% gain showing compound interest power. Notice that 69% of final value ($245K of $358K) came from the $96K in monthly contributions, not the $20K initial investment—proving that consistent small investments beat irregular large ones for most people.

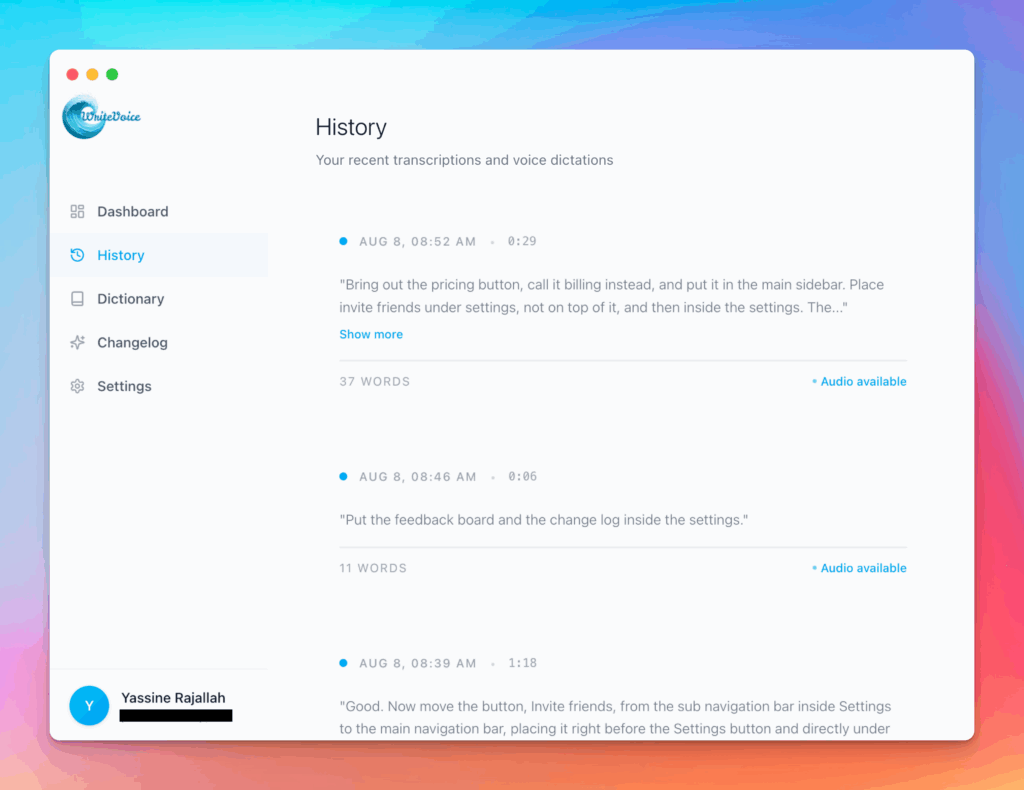

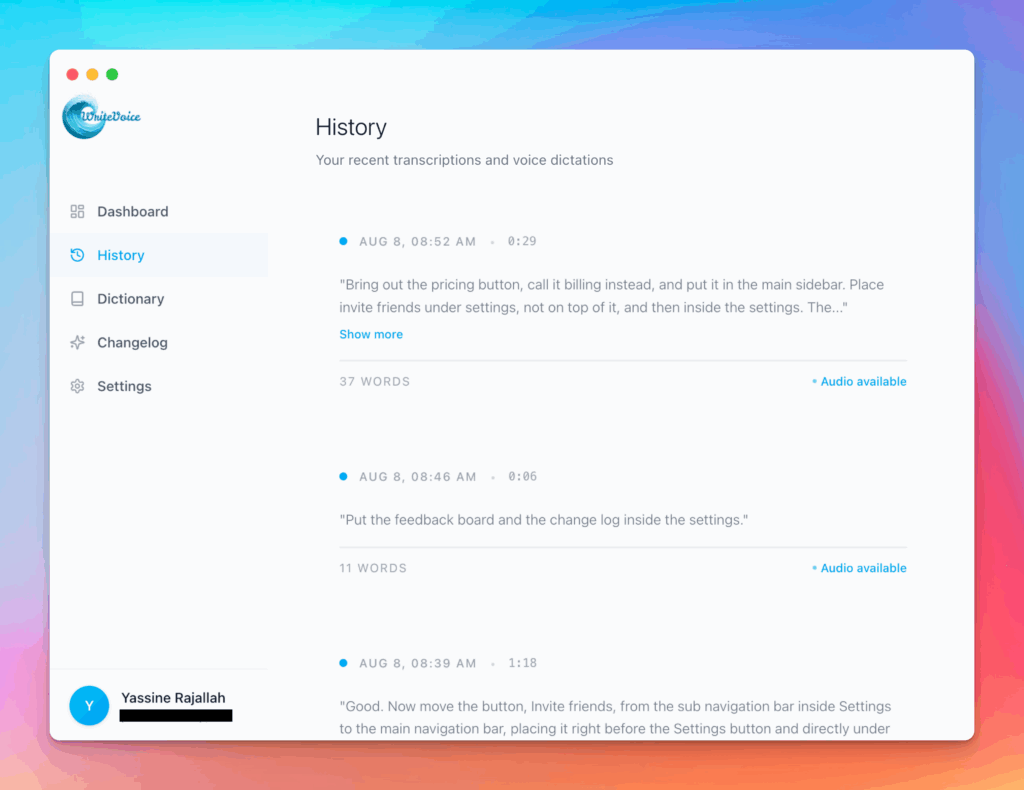

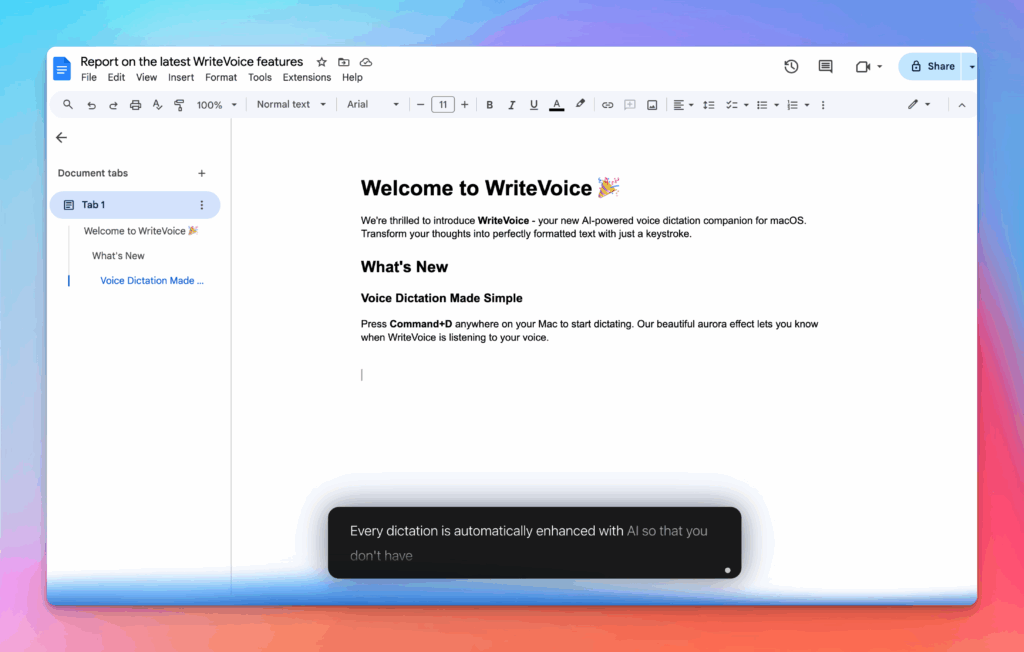

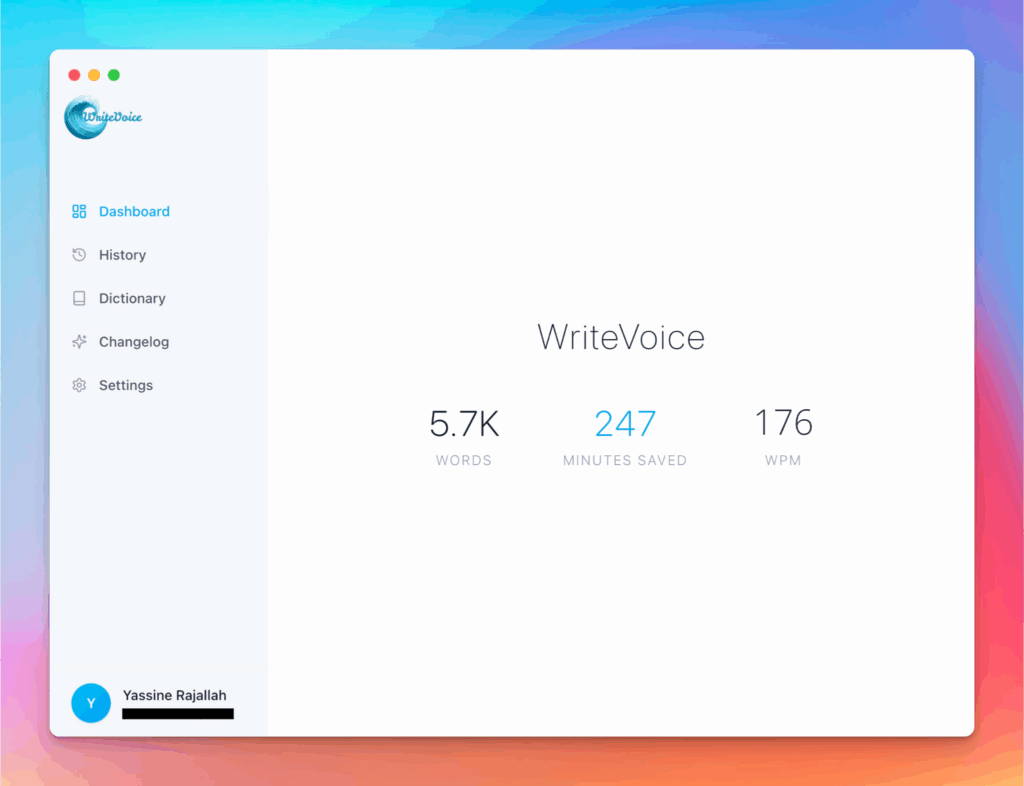

Meet the fastest voice-to-text for professionals

WriteVoice turns your voice into clean, punctuated text that works in any app. Create and ship faster without typing. Your first step was Investment Future Value Calculator; your next step is instant dictation with WriteVoice.

A blazing-fast voice dictation

Press a hotkey and talk. WriteVoice inserts accurate, formatted text into any app, no context switching

Works in any app

Press one hotkey and speak; your words appear as clean, punctuated text in Slack, Gmail, Docs, Jira, Notion, and VS Code—no context switching, just speed with writevoice

Accurate, multilingual, and smart

97%+ recognition, smart punctuation, and 99+ languages so your ideas land first try, built for teams and pros.

Private by default

Zero retention, audio and text are discarded instantly, with on-device controls so you can dictate sensitive work confidently.