Future Value Calculator with Withdrawals

Real-world investing includes withdrawals. Calculate future value accounting for periodic withdrawals in retirement planning.

How the Future Value Calculator with Withdrawals works

Model investment growth with scheduled withdrawals. Calculate sustainability, optimal withdrawal rates, and account longevity for retirement planning.

Retirement planning requires withdrawal modeling. This calculator shows if your nest egg survives retirement or needs adjustment.

How it works

Tutorial

Retirement planning isn’t just about accumulation—it’s about understanding if your nest egg survives retirement withdrawals. The famous “4% rule” suggests withdrawing 4% of your portfolio annually, but is that safe for your specific situation? Running out of money at 85 is terrifying, but being too conservative and dying with $2 million unspent means you sacrificed lifestyle unnecessarily. Future value with withdrawal calculations shows exactly how long your money lasts under different scenarios.

Whether planning early retirement, calculating required retirement savings, or managing existing portfolios, withdrawal modeling is essential. How much can you safely withdraw monthly? Will your portfolio last 30 years? What if markets underperform—what’s your worst-case scenario? This calculator models account balance over time accounting for both growth and withdrawals, revealing the sustainability of your retirement plan with specific numbers instead of hopeful guessing.

The Basic Formula

| Component | Formula | Purpose |

|---|---|---|

| Annual Withdrawal Amount | Initial Balance × Withdrawal Rate | First year withdrawal |

| Balance After Withdrawal | Beginning Balance – Withdrawal | Amount remaining to grow |

| Year-End Balance | (Beginning – Withdrawal) × (1 + r) | After growth applied |

| Inflation Adjusted | Withdrawal × (1 + inflation)ⁿ | Maintain purchasing power |

Step-by-Step Calculation

Example: $800,000 retirement portfolio, $40,000 annual withdrawals (5% initial rate), 6% annual return, 3% inflation-adjusted increases, 30-year retirement

Step 1: Setup Initial Conditions

| Parameter | Value | Explanation |

|---|---|---|

| Starting Portfolio | $800,000 | Retirement day balance |

| Initial Annual Withdrawal | $40,000 | 5% of initial balance |

| Expected Return | 6% | Conservative portfolio mix |

| Inflation/Withdrawal Increase | 3% | Maintain purchasing power |

| Retirement Duration | 30 years | Age 65 to 95 |

Step 2: Calculate First 5 Years Detail

| Year | Beginning Balance | Withdrawal | Growth | Ending Balance |

|---|---|---|---|---|

| 1 | $800,000 | $40,000 | $45,600 (6% of $760K) | $805,600 |

| 2 | $805,600 | $41,200 | $45,864 (6% of $764.4K) | $810,264 |

| 3 | $810,264 | $42,436 | $46,070 (6% of $767.8K) | $813,898 |

| 4 | $813,898 | $43,709 | $46,211 (6% of $770.2K) | $816,400 |

| 5 | $816,400 | $45,020 | $46,283 (6% of $771.4K) | $817,663 |

Step 3: Project Long-Term Sustainability

| Year | Balance | Annual Withdrawal | Status |

|---|---|---|---|

| 10 | $821,478 | $52,192 | Still growing |

| 15 | $818,024 | $60,476 | Peak balance |

| 20 | $793,510 | $70,081 | Gradual decline |

| 25 | $733,865 | $81,223 | Accelerating decline |

| 30 | $635,129 | $94,145 | Portfolio survived |

| Final Status | Portfolio Sustainable – $635K Remaining | ||

What This Means

With an $800K portfolio, $40K initial withdrawal (5% rate), 6% returns, and 3% annual increases, your money not only lasts 30 years—it grows to $635K by year 30. This happens because the 6% investment return exceeds the 5% initial withdrawal rate even after 3% annual increases. In the early years (1-15), your portfolio actually grows despite withdrawals. After year 15, withdrawals gradually exceed returns and the balance slowly declines, but remains substantial through year 30.

However, this assumes consistent 6% returns—unrealistic. Markets fluctuate wildly, and poor returns in early retirement years (“sequence of returns risk”) can devastate portfolios. If you experience -20% returns in year 1-2, the math changes dramatically. Always stress-test with conservative scenarios: 4% returns and 4% inflation would deplete this portfolio by year 28. The traditional 4% withdrawal rule ($32K initial withdrawal instead of $40K) would provide much more security, ending with over $1M after 30 years—enough to leave a legacy or fund unexpected medical expenses.

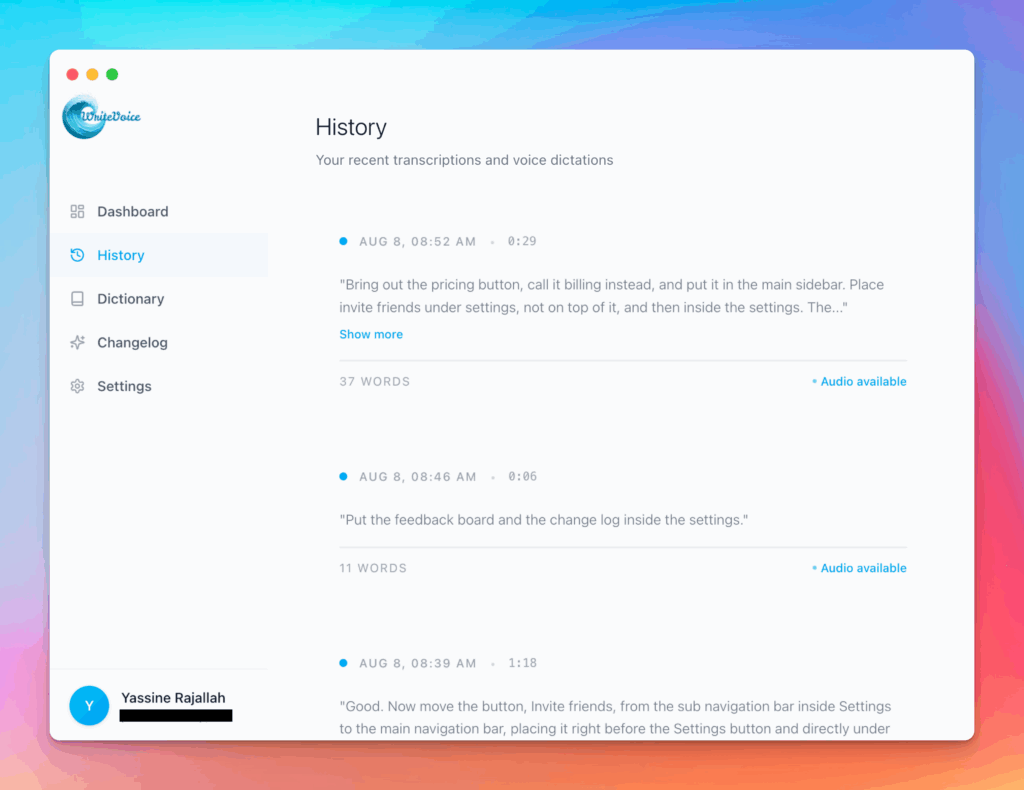

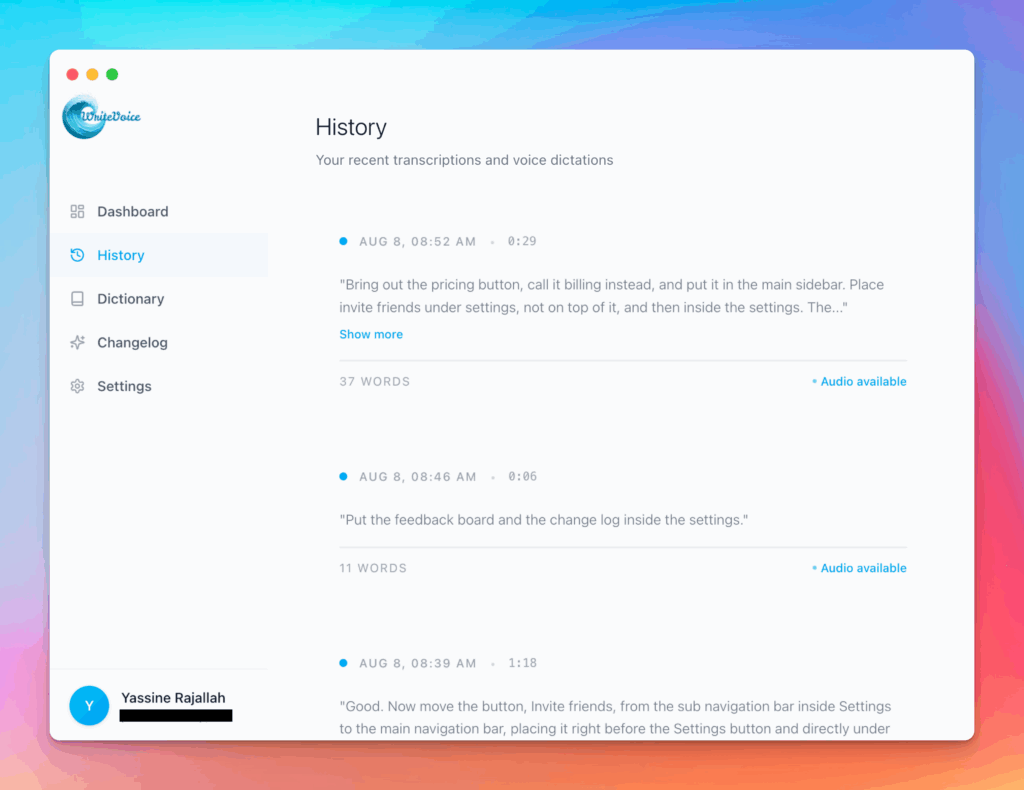

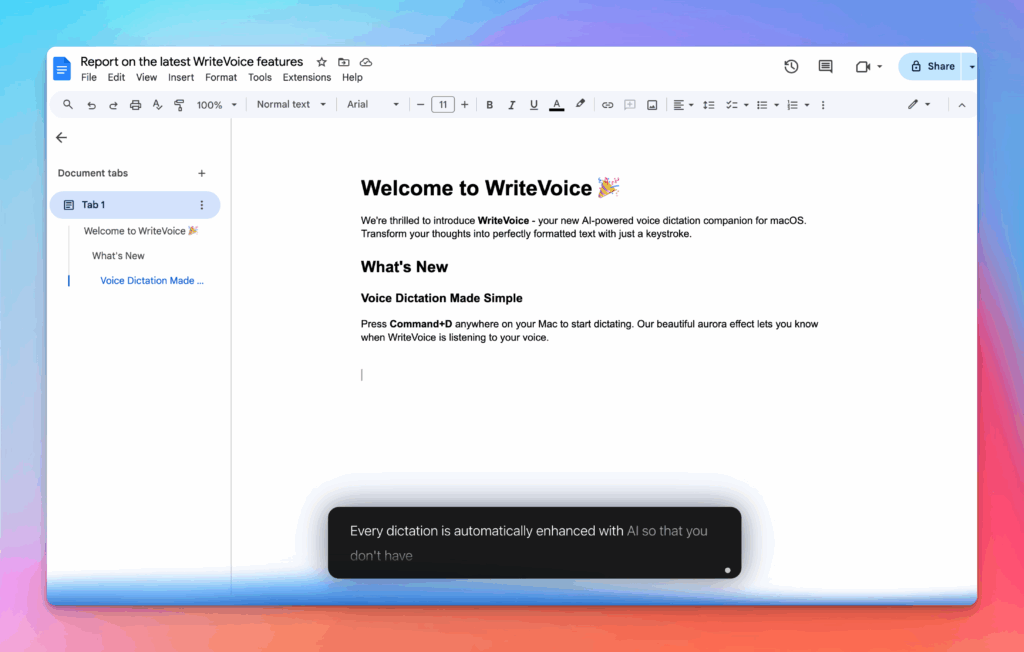

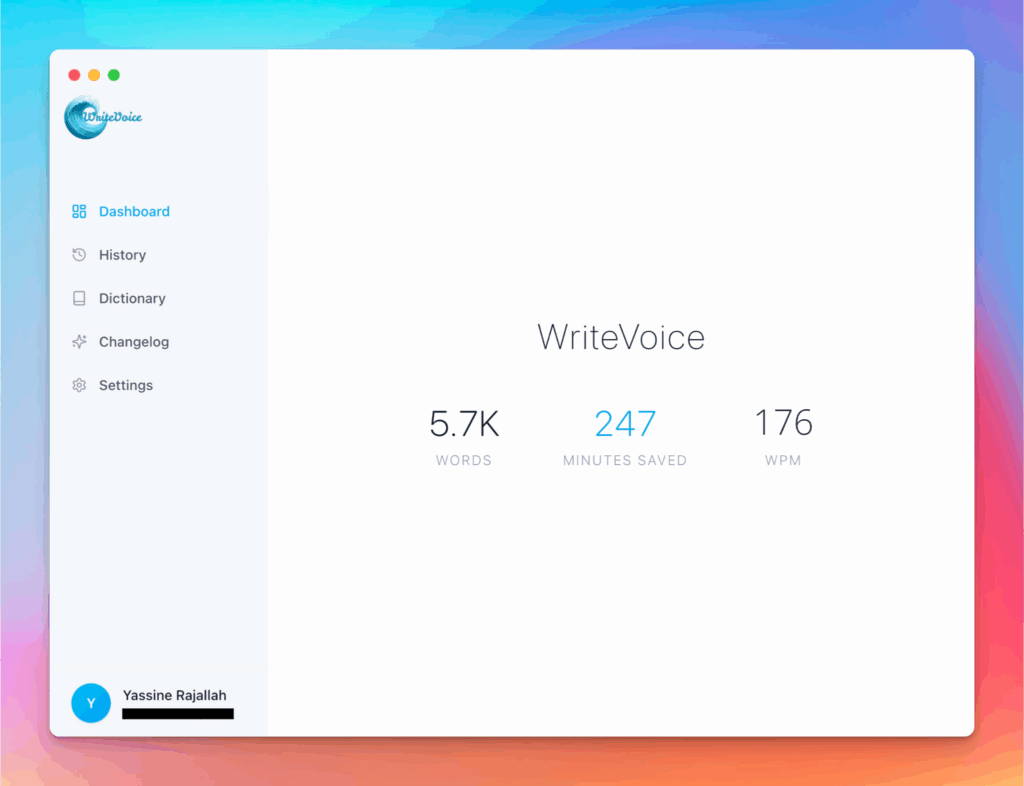

Meet the fastest voice-to-text for professionals

WriteVoice turns your voice into clean, punctuated text that works in any app. Create and ship faster without typing. Your first step was Future Value Calculator with Withdrawals; your next step is instant dictation with WriteVoice.

A blazing-fast voice dictation

Press a hotkey and talk. WriteVoice inserts accurate, formatted text into any app, no context switching

Works in any app

Press one hotkey and speak; your words appear as clean, punctuated text in Slack, Gmail, Docs, Jira, Notion, and VS Code—no context switching, just speed with writevoice

Accurate, multilingual, and smart

97%+ recognition, smart punctuation, and 99+ languages so your ideas land first try, built for teams and pros.

Private by default

Zero retention, audio and text are discarded instantly, with on-device controls so you can dictate sensitive work confidently.